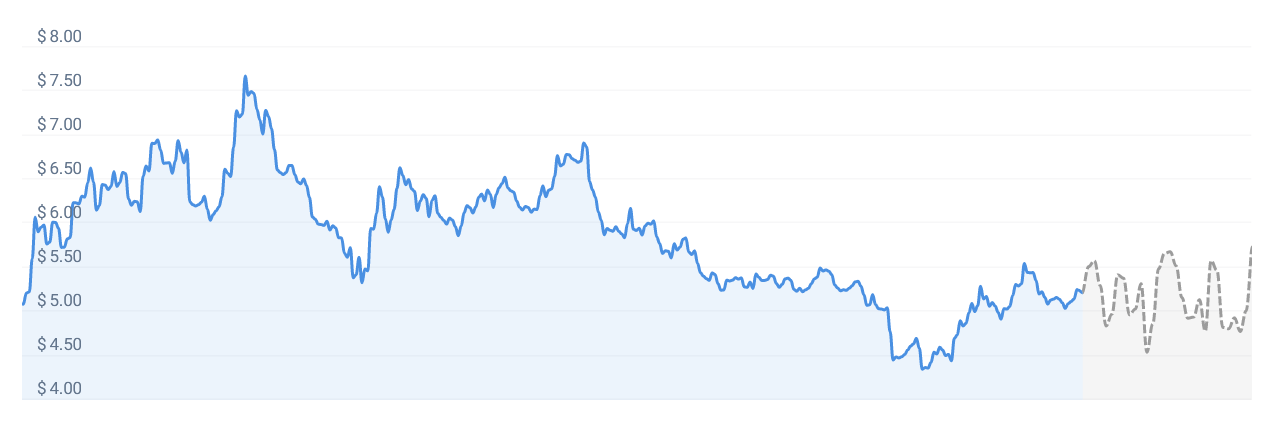

The evolving domain of cryptocurrencies brings with it a multitude of digital assets, each with its unique appeal and potential. One such currency that has been a consistent point of interest is Polkadot, an open-source multichain protocol that facilitates the transfer of any data or asset across its blockchain network. However, our latest analysis predicts a potential downturn for Polkadot. Based on our current price prediction, Polkadot’s price is projected to fall by about -7.21%, settling at around $ 4.84 by July 17, 2023.

This prediction is informed by our proprietary algorithms and a series of technical indicators, which currently signal a “Bearish” sentiment for Polkadot. In market terms, a bearish sentiment indicates an expected downward price trend, potentially driven by an increased inclination of traders to sell their holdings rather than buy more. This insight provides a snapshot of the prevailing market sentiment, with the current atmosphere trending towards an expected decrease.

An additional tool that aids in deciphering the market’s emotional state is the Fear & Greed Index. This index evaluates various market factors such as volatility, market momentum, social media trends, and market dominance to identify the dominant sentiment. In a seemingly paradoxical revelation, the Fear & Greed Index for Polkadot is currently at 57, indicating “Greed”, despite the overall bearish sentiment. This juxtaposition could suggest a complex market situation where potential investors might be grappling with the fear of missing out (FOMO) on a rebound even amidst a general negative sentiment.

Looking back at the past 30 days, Polkadot has demonstrated a certain resilience, with 18 out of 30 green days, which accounts for 60% of the time. Green days are those in which the digital asset closes the day at a higher price than its opening, signalling intervals of growth even amidst the larger bearish trend. This data suggests that despite a bearish inclination, Polkadot has shown consistent periods of positive returns, although they might be intermittent and possibly diminishing.

Another critical facet to consider is Polkadot’s price volatility, which was recorded at 6.17% over the past month. Volatility, in the crypto realm, serves as an indicator of the asset’s price range fluctuations over a certain period. While it does represent a certain degree of risk due to the potential for substantial price swings, it can also offer substantial gains for those well-versed in navigating the crypto markets.

Despite these factors, our current Polkadot forecast suggests that it may not be the most opportune time to invest in this cryptocurrency. This advisory stance stems from a careful analysis of market conditions, technical indicators, and the predicted price trend. It’s crucial for potential investors to understand the risks associated with investing in digital currencies like Polkadot, given their volatility and sensitivity to market news, technological breakthroughs, and global economic developments.

In summary, our current analysis indicates a potential decline in Polkadot’s price in the coming days. Even though the Fear & Greed Index showcases ‘Greed’, the overarching bearish sentiment is more dominant, advising potential investors to approach with caution. As is always recommended, potential investors should engage in thorough research, stay updated with market trends, and, if necessary, seek expert advice before making any investment decisions in the volatile and unpredictable world of cryptocurrencies.